U.S. President Donald Trump’s trade war threatens to put more than a million Canadian workers out of a job. Governments at all levels must take action to support workers through this difficult time and make sure that no one is left behind.

So far, the Federal government has introduced four temporary changes to Employment Insurance. These changes do not even begin to meet the current need for adequate, widely accessible income support that this moment calls for. Read on to learn what they are (and what changes are really needed to protect workers.)

1) Removing the 1-week Employment Insurance waiting period

Normally, the first week after you applied for EI is not paid. This unpaid week is called the waiting period.

NEW: For 6 months between March 30, 2025 and October 11, 2025, this 1-week waiting period has been cancelled for both EI regular benefits (unemployment) and special benefits (including maternity, parental, sickness, and caregiving benefits). This means that workers will now be paid for their first week of unemployment.

This change does not increase the total number of weeks of benefits that you become eligible for. For example, if you are eligible for maternity benefits, you will still get 15 weeks of EI benefits, not 16 weeks. The benefits just start a week earlier and end a week earlier.

2) Allowing workers to receive both separation payments and Employment Insurance together

Normally, any payments you receive after you are laid off need to be “used up” before you start receiving EI benefits. In other words, your EI benefits can be delayed if you get termination pay, vacation pay or severance pay. For example, if your normal weekly wage is $500, and you received a total of $1500 in total for termination and vacation pay, your EI benefits will only start 3 weeks after you leave your company.

NEW: For 6 months between March 30, 2025 to October 11, 2025, any earnings that you get when you leave your job will not be deducted from your EI benefits. This means workers can receive both separation payments and EI at the same time.

3) Making Employment Insurance slightly easier to qualify for

The number of weeks you receive Employment Insurance depends on the number of hours you have worked and the regional unemployment rate where you live. (You can find out your regional unemployment rate based on your postal code.)

If the unemployment rate in the region where you live is high then it is easier to qualify for EI, and you can also get more weeks of benefits. For example, if your regional unemployment rate was 6% or less, you would need to have worked 700 hours to access 14 weeks of benefits. But if your regional unemployment rate is instead 8.1% and you have worked 700 hours, the number of weeks you can access goes up to 20 weeks of benefits.

NEW: For 3 months between April 6, 2025 to July 12, 2025, the regional unemployment rates will be adjusted to make it slightly easier to get EI. Essentially, workers can qualify for up to four more weeks of EI and the minimum they need to work to qualify is 630 hours. In regions with a higher unemployment rate, the number of hours needed to qualify could be as low as 420 hours.

| Regional Unemployment Rate – New Employment Insurance Changes | ||

| Actual unemployment rate | Adjusted unemployment rate | Minimum hours needed to qualify on the adjusted unemployment rate |

| 6.1% or less | 7.1% | 630 |

| 6.2% to 12% | 1% is added | 455 to 630 |

| 12.1% to 13% | 13.1% | 420 |

| 13.1% to 16% or more |

No change | 420 |

This system is complicated and creates too high a threshold of eligibility for most workers. Even with these changes, workers in the GTA will still need 4.5 months of uninterrupted, full-time employment (35 hours per week) before they can access EI. We all know that it is hard to get consistent full-time work, especially when so many jobs right now are part-time, temporary, self-employed, or have unstable hours. That is why there should be a single entrance requirement of 360 hours for workers in all regions!

4) Expanding access to the Employment Insurance Work-Sharing program

The EI work-sharing program allows employers and employees to avoid layoffs when there is a business slow-down that is beyond control of the employer. This can be done through an agreement between the workers and the employer which can be supported by a union if there is one. Workers must agree to reduce their normal working hours and share the available work among them. In exchange, workers are allowed to access EI benefits during this time of reduced hours.

NEW: For 12 months between March 7, 2025 and March 6, 2026, it will be easier to qualify for the work-sharing program. For example, employers only need to operate in Canada for a minimum of 1 year instead of 2 years. Furthermore, seasonal employees can now also qualify for work-sharing benefits. For a full list of who can now apply please go to the Federal Government website on work-sharing.

The Problem: Too many of us still cannot get Employment Insurance!

These temporary changes do not go far enough to ensure that all workers can get Employment Insurance. To date, the announcements will only apply to workers who are currently eligible for EI. But only about 35% of people who are unemployed actually can get EI benefits. The majority of these very small changes do nothing to address the more than 65% of unemployed workers who cannot access EI regular benefits.

These changes are also very temporary and we know that the tariff crisis is going to impact many sectors for a long time as industries pivot or make structural changes. Workers need permanent changes that improve access to Employment Insurance and increase the amount of benefits each worker can receive.

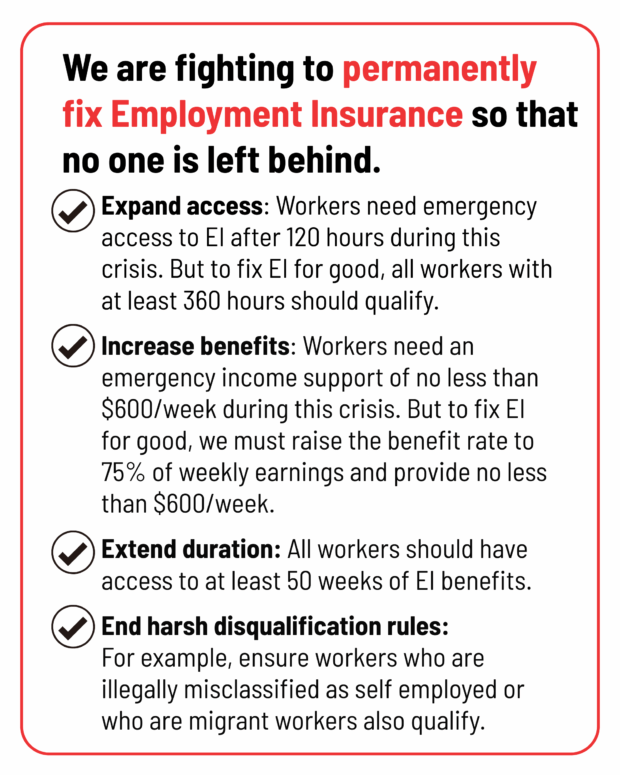

Here are the improvements we are fighting for:

Expand Access: More people used to be able to get Employment Insurance. In the 1970s and 1980s, about 75-80% of unemployed people could receive EI. But now this number has dropped to only 35-40%. 630 hours of work required to qualify is still too high for many part-time or temporary workers. For example, if you were a part-time worker working 20 hours a week, you would need to work 8 months straight.

- During the crisis created by the trade war, workers need emergency access to EI after 120 hours.

- To fix EI for good, we need to also permanently change eligibility criteria so that workers with at least 360 hours (12 weeks) qualify for EI, no matter where they live.

Improve Weekly Benefit Rates: The government has not made any changes to the minimum benefit rate. Currently workers only receive 55% of their average weekly income on Employment Insurance. That means some workers could receive as little as $200 a week. This is not enough to live on, especially given the high cost of living and the likelihood that tariffs will create more inflation.

- During the economic crisis created by the tariff war, workers need access to an emergency weekly income support of no less than $600 per week.

- To fix EI for good, we need to make $600 per week the minimum amount any worker receives and permanently raise the benefit level to 75% of average weekly earnings.

Improve Duration: Due to restrictive eligibility criteria, many workers run out of EI benefits before they find another job. In these times of extreme economic uncertainty, many workers are finding it extra difficult to land a new job. Tariffs may also cause a major restructuring of the economy, which means that workers may need to retrain for different jobs in order to find work.

- To fix EI for good, we need to make sure all workers have access to at least 50 weeks of Regular EI benefits.

- Providing EI income benefits to workers who are in approved training programs and extending the benefit period for combined Regular and Special EI benefits will also ensure that workers and our economy can adapt in these rapidly changing times.

End Harsh Disqualification Rules: Expanding the work-sharing program will only help a small portion of workplaces as it requires negotiations between workers and their employer. This is more likely to happen in unionized workplaces which leaves out many workers.

- We are fighting to fix Employment Insurance so that workers who are misclassified as self employed or who are migrant workers can also have access to emergency benefits.

Finally, all four temporary changes to Employment Insurance will end anywhere from 3 months to a year. But we cannot settle for band-aid solutions.

- We need to ensure that EI is permanently fixed. EI is an important income benefit for all of us and no one should be left behind!

If you need help applying for Employment Insurance or have difficulties applying, please contact us at the Workers’ Action Centre.

Instagram

Instagram